PayPal Freeze Or Terminate Your Account? Recover With PayKings

May 20, 2023

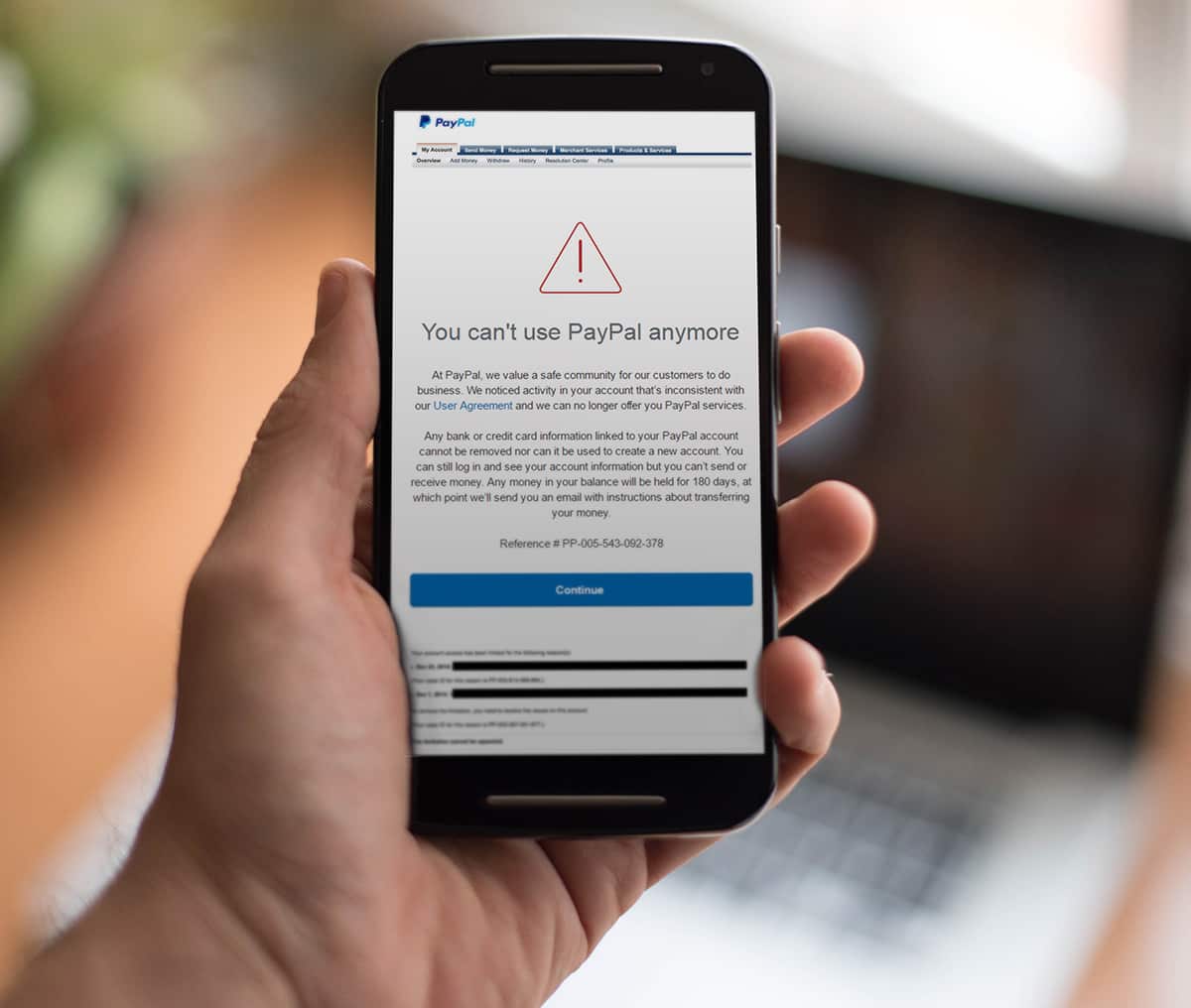

When an aggregate merchant account like PayPal, Stripe, or Square kick you off their platform or freeze your account, it can be confusing as to what to do next. Well, we’re here to answer all of your questions and to take the guesswork out of what your next steps should be. Here, we’ve laid out exactly how to handle this type of situation. It actually happens more often than you’d think.

Oops! We could not locate your form.

PayPal Account Frozen

A dedicated merchant account is an account where the business has its own merchant ID, wherein the merchant is not sharing a merchant account with several other businesses. Very much unlike an aggregate account like PayPal, Stripe, or Square who uses one merchant account for an entire portfolio of merchants.

A business has far less control with an aggregate account than they do with a dedicated merchant account. With a dedicated merchant account, transactions between the merchant and the customer are deposited directly into the business bank account.

With an aggregate account, the funds from a transaction are sent to the account provider, like PayPal. The funds are then deposited into the merchant’s bank account. The aggregate account provider also makes their own rules. They can make any changes deemed necessary without your consent.

Stripe Account Frozen

The upside to an aggregate account is that there is no underwriting process, unlike a dedicated merchant account where there is a very strict and thorough underwriting process that can determine whether the merchant will be approved or declined for a dedicated merchant account. Dedicated merchant accounts also tend to have much cheaper transaction fees.

Chances are, if you were dropped from one of the major aggregates it is only a matter of time before you are dropped from the others. This means that the clear next step will be to apply for a merchant account with an assigned and specific merchant ID.

When you apply for a merchant ID, you own your dedicated merchant account. It will take a bit longer to set up once you have to be approved for it. However, the benefits far out way the inconvenience of a lengthier process; which is due to the underwriting process that is used to determine if you are a good fit for the banks.

Reasons PayPal Freezes Your Account

The underwriting process also determines how much you will pay per transaction, which can end up being significantly less than what you would pay with an aggregate account. This is because dedicated merchant accounts are customized to fit your individual business needs. Unlike aggregates who throw you into a portfolio with tons of other merchants and charge one flat fee.

Your dedicated merchant account is also being monitored. Information about your business is being collected and used to prevent fraud, excessive chargebacks, and abnormal behavior. In the instance that something is flagged, you (the merchant), are then notified immediately in order to identify the problem and fix it. This definitely beats what typically happens with aggregate accounts, where they won’t notify you until your account is shut down or at the very least – completely frozen.

You will also find that you are paid much faster as you are not dependent upon an aggregator to receive the money first and then send those funds to your bank account. With a dedicated merchant account, the funds from a transaction go straight into your business’s bank account.

So, what happens now?

What To Do When Payments Freeze

The next step is to find a merchant processor or a bank who can meet the demands of your business, won’t shut you down for ridiculous reasons, and will provide you with a competitive rate.

Going straight to a bank can be tough. Going to more than one bank can be even tougher. As your credit is constantly being pulled, you may be denied multiple times based on several unknown factors until it’s too late.

This is why it is best to seek out a merchant processor that has great relationships with several banks. It’s even better when that merchant processor has an in-house underwriting team that will cross every T and dot every I to make sure that you are presented in the absolute best form possible before your application is sent to a bank.

A merchant processing company like this is incredibly difficult to find. However, over here at PayKings, we are the Merchant Payment Processing Company that meets those exact specifications.

Payment Solutions After PayPal Drops Your Account

PayKings’ area of excellence is getting high risk businesses approved for difficult merchant types, business models, and restricted product types. This is done via PayKings direct and our network of 20+ banks and PSP’s.

So, to recap. How do you recover when an aggregate like Paypal, Stripe, Square, or the like decides to shut down your merchant account without any notice?

You apply for a free quote online with PayKings and get the ball rolling to a better way of payment processing.

May 20, 2023 | High Risk Merchant Account | Guest Post