Protect Your Business From Fraud with a Merchant Account from PayKings Featuring iSpyFraud™

Apply Today

What is Fraud Prevention?

Ecommerce Credit Card Fraud Prevention

Though incidences of credit card fraud are confined to approximately 0.1 percent of all card transactions, they have led to huge financial losses since the fraudulent transactions have been large-value trades.Merchant Fraud Protection

When a retailer begins accepting online payments, they have officially entered the card-not-present world. For a consumer, the choice between buying merchandise online or in-store merely comes down to a matter of convenience, cost, and availability.

Buying online versus in-store are two very different scenarios, especially concerning the liability for accepting a fraudulent transaction.

When a retailer begins accepting online payments, they have officially entered the card-not-present world. For a consumer, the choice between buying merchandise online or in-store merely comes down to a matter of convenience, cost, and availability.Online Payment Fraud Protection

Buying online versus in-store are two very different scenarios, especially concerning the liability for accepting a fraudulent transaction. For the eCommerce merchant, a card-not-present (CNP) transaction means that the cardholder isn’t physically present with the credit card when using it for a purchase with the merchant. For online sellers, having credit card fraud protection for merchants when you launch is an important step.Fraudulent Transaction Prevention

With no standard security measures like checking identification and paying using a chip reader card, an internet transaction is deemed to have far less eCommerce fraud prevention and eCommerce fraud protection measures. Given the risk involved with accepting an online transaction, the liability of accepting a fraudulent transaction rests with the retailer themselves, rather than the issuing bank. If a merchant accepts an order online that is later deemed a fraudulent transaction, it’s the merchant’s responsibility to refund the consumer. The cardholder’s issuing bank will collect on behalf of the cardholder. Understanding this liability is essential for online retailers. Many of whom are unaware of their duty to examine their online purchases closely to weed out credit card fraud they may be on the hook for.

Best Ecommerce Fraud Protection

It’s imperative that a merchant implements online credit card fraud detection steps to provide some sort of eCommerce merchant fraud prevention service. This will safeguard them from the costs of fraudulent transactions, and credit card fraud as a whole. Firstly, the entire cost to the merchant for accepting a single fraudulent purchase is often more than double the cost of the actual purchase itself. This is because they cannot recover the original merchandise or services that had been fraudulently shipped. In addition, they must repay the defrauded customer.Secondly, the retailer’s bank (known as the acquiring bank, together with whom the merchant stores their money) heavily monitors their customers for credit card fraud acceptance. They might charge a fee for each and every chargeback received.

How to Get Credit Card Protection for Merchants

If the merchant starts to process tens of thousands of fraudulent transactions, an acquiring bank might drastically raise credit card fees. They might even take steps to shut down a retailer’s merchant account altogether. All of this information is not meant to overwhelm you with all this talk of credit card fraud. As an eCommerce retailer, it’s important to educate yourself about what credit card fraud looks like. Understand what it involves and how to arm yourself with eCommerce credit card fraud protection for merchants.Luckily for you, if you’re looking for credit card fraud protection services for merchants, you’re in the right place. At PayKings, we have the technology and partnerships with leading fraud prevention experts to provide the best payment processing solutions for your business.

Learn more about PayKings’ iSpyFraud protection services:

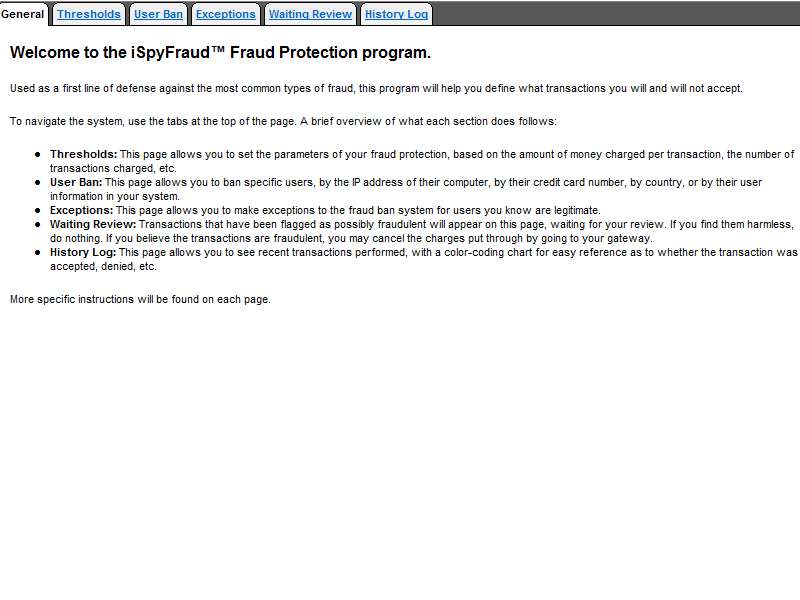

iSpyFraud™ – Detailed Overview

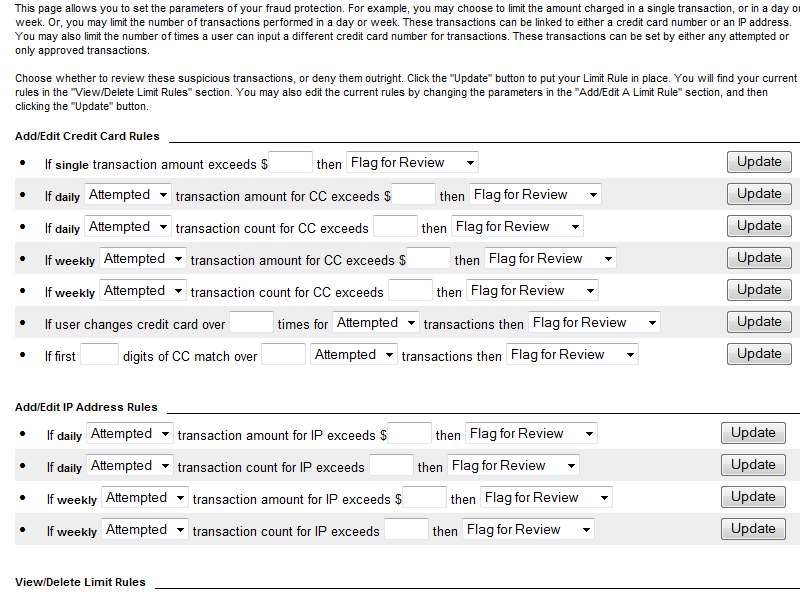

1. Dynamic Building of Fraud Scrubbing Rules

At a Glance, you can view some of the rule building controls. You can create both “Flag For Review” or “Deny” rules. Furthermore, you can differentiate between Attempted and Approved transactions. This gives you the flexibility of keeping someone from trying to spin credit cards and detecting it before they get any transactions approved.

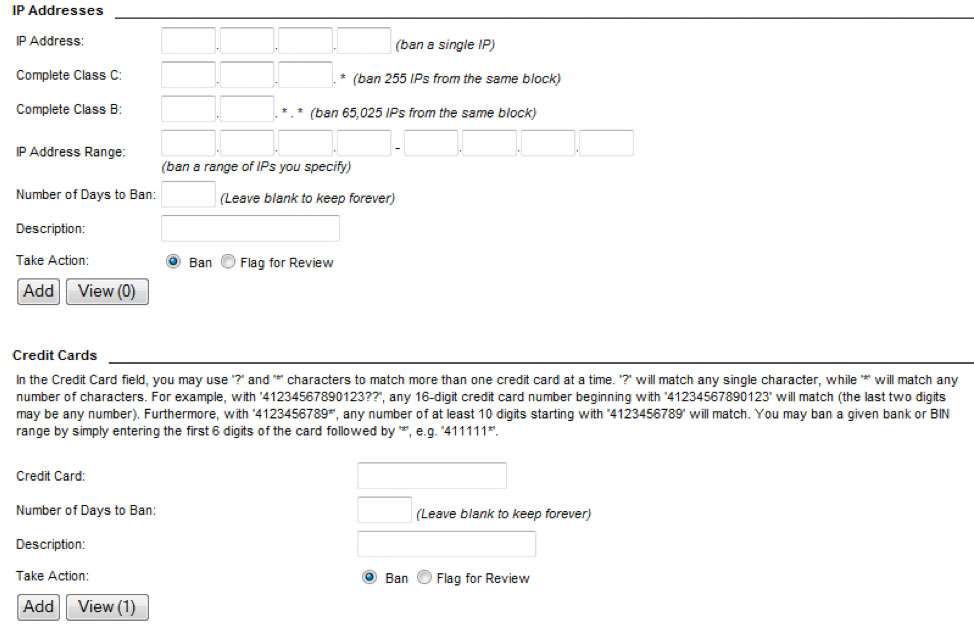

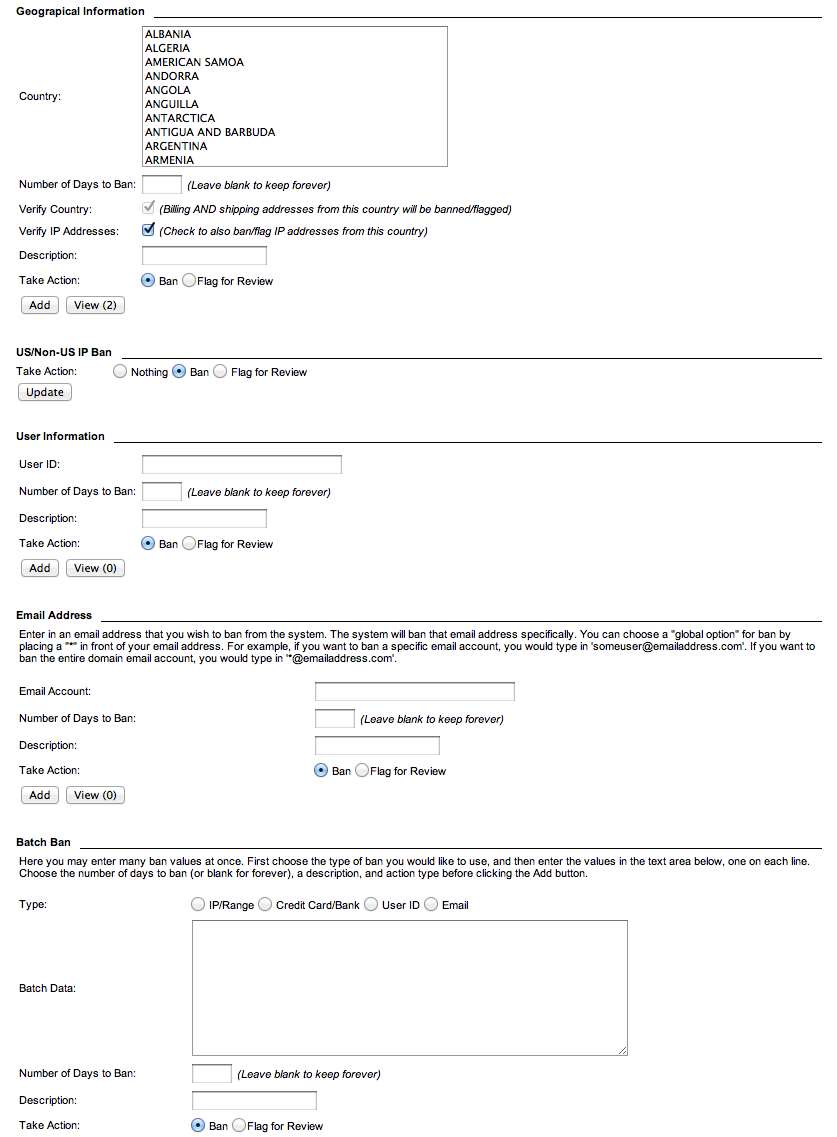

2. Static Rule Banning / Blacklisting

Along with Dynamic rules as specified above, you can also input Static rules such as banning specific countries, IP Address Ranges, Credit Card Numbers, E-Mail Addresses, etc …

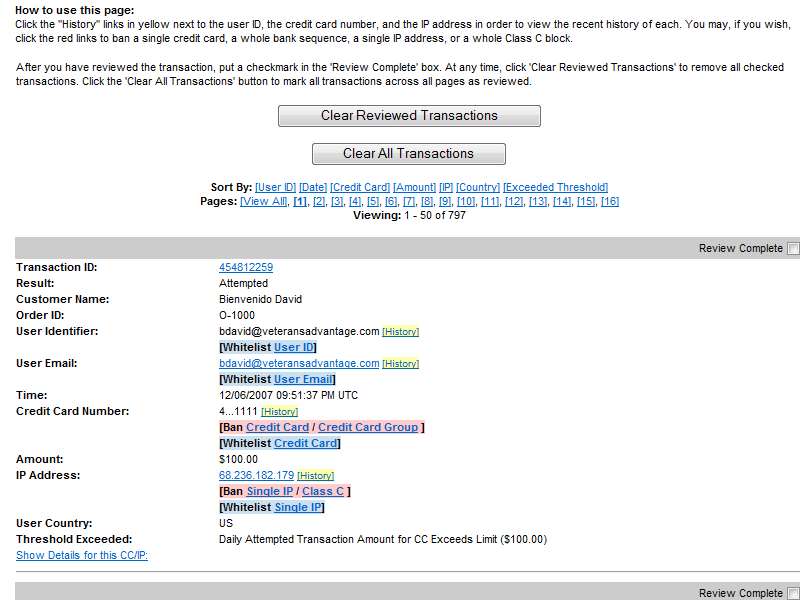

3. Review Transactions Marked as Suspicious

The Waiting on Review Tab allows you to view any transactions that have been flagged as suspicious. From here, you can cancel or approve transactions. This dashboard will also tell you what rule(s) have been triggered that caused the transaction to be flagged as suspicious.

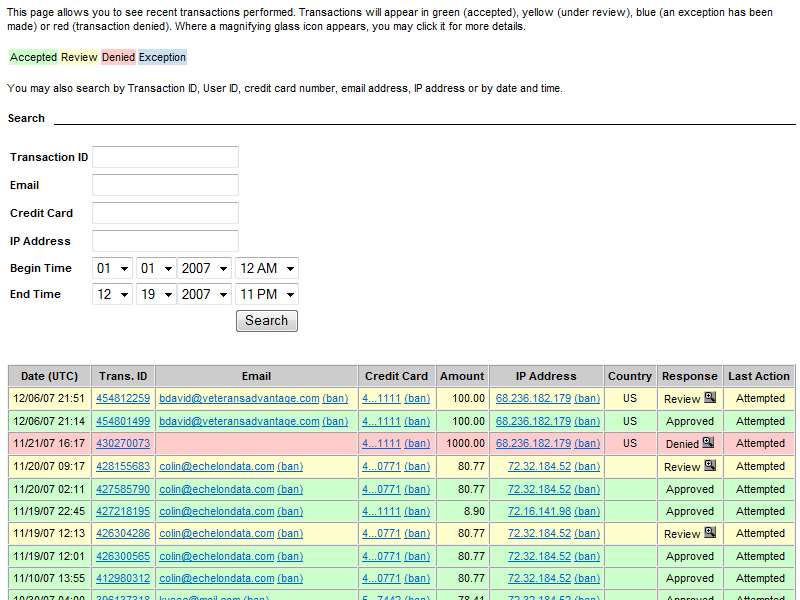

4. Full audit history of all transactions – scrubbed or not

Lastly, you can use the History tab to review all transactions. This is helpful when trying to understand and determine credit card fraud patterns. You will be able to see all approved, whitelisted, blacklisted, reviewed, and declined transactions. You can search by IP Address, Transaction ID, etc in order to look for obvious patterns.