Continuity Subscription Merchants

August 18, 2023

Continuity subscription merchants are realizing the importance of ongoing revenue to grow their business. This billing model allows companies to have a secure and consistent customer base that they can count on. However, there are challenges when it comes to passively processing financial transactions like this.

For instance, subscription merchants or a recurring payments structure is not considered a traditional category by many banks. Due to the high volume of sales and risk of fraud, banks limit and vet subscription merchant accounts. Therefore, businesses and entrepreneurs using this strategy need to partner with a top continuity subscription merchant processor to find an efficient and secure way to ensure their ongoing transactions.

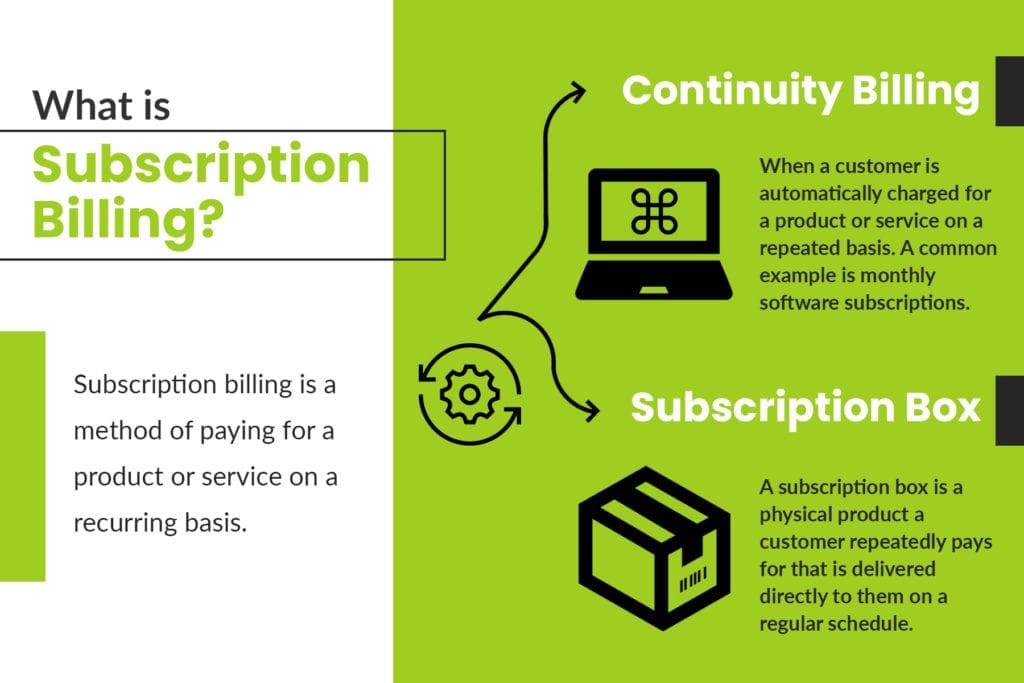

What is Subscription Billing?

Getting A Continuity Billing Merchant Account

If a business wants to use continuity subscription merchants, the first requirement is to have a subscription merchant account that accepts credit cards. Businesses can miss out on many opportunities if they are not using recurring payments.

If a business wants to use continuity subscription merchants, the first requirement is to have a subscription merchant account that accepts credit cards. Businesses can miss out on many opportunities if they are not using recurring payments.

However, it is important to note that it may be difficult to acquire an account through standard means. This is often due to the risk of customers claiming chargebacks.

Chargebacks mean that the customer asks for their payment back. Although they are very common in any business, however, in subscription businesses, they historically happen more frequently.

A standard rule for the number of chargebacks allowed is 2% of all transactions. However, due to the number of resources they take up, this percentage is steadily decreasing. If your business exceeds this, your account may be closed down.

The Challenge Behind Continuity Merchant Accounts

The price models of subscription businesses make them a risk for traditional banking systems.

In this model, the customer’s credit card will get charged with recurring payments unless they decide to cancel the subscription. Therefore, continuity subscription merchants need to make their charges aware to the customer and keep them informed of ongoing transactions before they become an issue.

However, the problem with chargebacks always stands. It is possible that a customer wins a chargeback claim due to a minor technicality on their part. In some cases, when a large number of customers claim chargebacks, the bank may end up losing its money. So, continuity subscription merchants will always be seen as a risk for banks.

Mitigating the Issues for Subscription-Based Businesses

Subscription-based businesses must partner with a reputable continuity subscription merchant. A reliable merchant account provider will have a thorough understanding of this type of business model and financial institution. Additionally, there are services that help you make the most of continuity billing and reduce chargebacks altogether.

Marketing Subscription Billing

Continuity subscription merchants use a different style of marketing. They need to stay top-of-mind. Unconventionally, this is awareness is not to complete the initial sale, but to show value every month. Customers will be billed on a recurring basis unless they cancel their subscriptions. So, customers can defer this service for single month billing, free trial offers, or other types of charges that would not incur automatic renewals. Showing benefits to provide value otherwise is key.

Continuity Subscription Accounts – How they Work?

In the subscription business and payment model, the consumer is charged continuously until they opt or unsubscribe. Any business can use this model to provide or deliver items or services that need to refilled or restocked every month. The most common examples include subscription boxes and software services. For such businesses, a recurring model for a payment gateway is efficient and convenient.

In the subscription business and payment model, the consumer is charged continuously until they opt or unsubscribe. Any business can use this model to provide or deliver items or services that need to refilled or restocked every month. The most common examples include subscription boxes and software services. For such businesses, a recurring model for a payment gateway is efficient and convenient.

But some merchant services misuse the trust of the customers. They hope that the customer will forget about the subscription, and automate payments after offering a free trial or a freebie. Such scams result in excessive chargebacks.

Bottom Line

The biggest issue that a business may face is to have the merchant account suspended even though it was not their fault. A dependable merchant account providers like PayKings has established partnerships to help reduce the risk of chargebacks.

This way, subscription-based businesses can focus on growing business rather than dealing with the issues associated with continuity billing.

August 18, 2023 | Merchants | Guest Post